The Racket > Bank of America Style...

Money Magic !!

Money Magic !!

This is just an overview of the Racket. There are far more details provided in other documents and pages on this website.

General Nature of the racket as it applies to me:

General Nature of the racket as it applies to me:

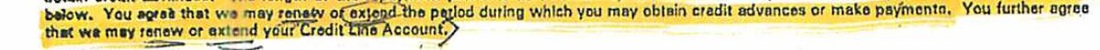

- My HELOC Agreement was originated in 2005, and it had a "vague" renewal clause. The vague clause was NOT appropriate for a banking agreement. The vague clause alone was indicative of a "derivative banking product". This product that had the potential to be extremely damaging with a single deviant arbitrary decision by a deviant banker. The "vague" renewal clause is below:

- Bank of America's "standard operating procedure" in 2005 was to renew Resetting HELOCs with a simple but appropriate process including a home appraisal and basic income verification. Part of the origination/sales process was to "educate consumers" on the nature of the Reset/Renewal process. Bankers assured consumers they had never seen the bank "not renew", and as such, consumers were to take this 'vague' renewal clause to assume the bankers were of good intention. Bankers also encouraged consumers to ignore the extraneous repayment period as it would be irrelevant as long as the renewals proceeded as typical.

- At time of HELOC Reset in 2015, Bank of America did NOT mention the renewal option. When I asked about my renewal option, I was told my Agreement did not have a renewal clause. When I presented my Agreement and discussed the Modus Operandi and sales presentation at time of origination, I was simply told Bank of America was not offering a renewal application process. When my Reset file got escalated to Bank of America Legal much later in the Reset process, David Tinkler, Assistant General Counsel of Bank of America Legal wrote "as a matter of policy the bank has not exercised it's renewal option for many years". When an arbitrary matter of policy creates a 288% payment increase that benefits the bankers to the detriment of the consumer and their local economies, we all need to wake up.

- By avoiding the renewal, the line of credit becomes "frozen", and I was forced into a non-natural 15 year repayment period resulting in a 288% payment increase. When an arbitrary denial of a renewal causes a 288% payment increase, we all need to wake up.

- In the face of 288% payment increase, a depressed real estate market, and tightened lending guidelines many are trapped in these Agreements. In a show of compassion, Bank of America offered a "repayment term extension application process" that would lower the pending increase from 288% to 211% (which is still a huge payment increase). Unfortunately, BofA Execs implement nonsensical program guidelines that enabled them to deny all repayment term applications. It was a fake payment reduction process, intended for outward appearances only.

Alternate Racket That applies to Bank of America Customer's and other's who signed HELOC agreements without renewal clauses from 2004-2007:

- In the mid 2000's renewal clauses in HELOC Agreements across the industry saw the removal and/or dumbing down of renewal clauses. Given all Agreements shifted in the same time frame, it's obvious it was conspiratorial in nature and indicative of industry wide collusion.

- At time of reset, if the housing market is depressed as compared to time of origination, consumers will be trapped in a 288% payment increase without needing to make an "arbitrary" denial for renewal.

- In the face of 288% payment increase and a depressed real estate market, which traps many in these illogical repayment terms, Bank of America pretended to be interested in providing financial relief. I was offered a "repayment term extension application process" that would lower the pending increase from 288% to 211% (which is still a huge payment increase). Unfortunately, BofA Execs implement nonsensical program guidelines that enabled them to deny all repayment term applications. It was a fake payment reduction process, intended for outward appearances only.

The FAKE Repayment Term Extension Application process details... A to Z...

Once a customer was trapped by Bank of America, either via an arbitrary renewal denial or via their HELOC Agreement that was void of a renewal option, they were faced with a 288% payment increase.

In order to appear "compassionate" and/or in order to comply with government requests for compassion, Bank of America offered a "repayment term extension application process" which would extend the default repayment term from 15 years to 25 years and it would reduce the ending 288% increase to 211%. Unfortunately it was a fake payment reduction process setup for outward appearances only.

Below is a summary of the fake process. Please see the "Chronology" page for the gnarly and disgusting details.

In order to appear "compassionate" and/or in order to comply with government requests for compassion, Bank of America offered a "repayment term extension application process" which would extend the default repayment term from 15 years to 25 years and it would reduce the ending 288% increase to 211%. Unfortunately it was a fake payment reduction process setup for outward appearances only.

Below is a summary of the fake process. Please see the "Chronology" page for the gnarly and disgusting details.

- Specify a full underwriting process to "reduce" the payment. (Question: How do you financially justify reducing someone's payment? Question: PNC dropped a 208% increase to 47% with no underwriting process, why all the underwriting?)

- Refuse to divulge any details regarding the decision criteria for the payment reduction prior to and/or during the application process. Refuse to divulge any debt-income ratio qualification criteria during (because the Program Guidelines are set up as a double edged sword, and you need to to the underwriting to know which way the are going to be applied).

- During underwriting, calculate the 15 year debt-income ratio (an irrelevant ratio when trying to qualify for a 25 year payment term)

- If the 15 year debt-income ratio is too far above 45%, accidentally leave out a component to get it to a "close but no cigar" situation.

- Call the customer. Present the debt-income ratio without telling them it's a 15 year ratio and without telling them it's been modified to make this look like a close-but-no-cigar situation. Offer up the income component of the income ratio, go over each item, and then ask if the customer if they left out any income that could help them qualify (and hope like hell the customer doesn't realize that if income isn't on your tax returns it would never count, making this question a question that should NEVER be asked in an underwriting situation).

- If asked about the debt component in the debt-income ratio, claim that number is not immediately available (even though it takes 5 seconds to calculate with a calculator).

- If the customer quickly calculates the debt component and realize the debt component used is over stated for a 25 year repayment term, use attention manipulation techniques to focus on the income component.

- Close out the call by informing the customer of the potential for a mortgage modification application option. (and hope like hell the customer doesn't realize that if they just failed to qualify for the 25 year term due to risk there should be no more "applications" required to qualify for the next step down the Reset ladder to hell with Bank of America).

- If the customer elevates the call to management, have a Bank of America VP expose an illogical 2 ratio underwriting scenario where there is in fact a 15 year and 25 year ratio requirement.

- If the customer calls bull shit on the illogical 2 ratio underwriting scenario where a 15 year ratio was discreetly used to deny a 25 year repayment term, tell a big fat LIE by claiming the underwriting requirements are OCC requirements (OCC = the Office of Currency Control = the Government). (AND Hope like hell the cusotmer hasn't done a reset with another bank that can expose this LIE).

- Use US Mail to send out a denial notice stating "Current/Proposed debt is high relative to income" and hope that the fact that the customer was denied for a debt ratio that is NOT related to the current or the proposed situation is not made public.

- If the customer sees thru the entire HELOC racketeering illusion, have Bank of America legal offer a payment reduction but require the customer sign a non-disclosure agreement.

- I want the name of the person(s) who created this business process exposed.

- I want the name of the person(s) who did the employee training and/or the mind control work on these employees exposed.

- At this point, I'm in this for karmic justice as much as anything else, and all I need are name(s) for that