Synopsis

Participating in another Bank Contrived Crisis AND a fake underwriting process!

Participating in another Bank Contrived Crisis AND a fake underwriting process!

This website details my experience with racketeering activities at Bank of America related to 1) a derivative Home Equity Line of Credit (HELOC) Agreement, 2) a nefarious Reset process and 3) deviant Bank of America Executives.

This website also exposes industry wide collusion related to the creation of derivative HELOC Agreements both past and present by colluding Legal Departments at every Big Bank in the country.

== Website Launch - 10.20.2015 ==

== Situation Status as of 12.23.2015 ==

== CFPB Case Status as of 1.19.2016 ==

This website also exposes industry wide collusion related to the creation of derivative HELOC Agreements both past and present by colluding Legal Departments at every Big Bank in the country.

== Website Launch - 10.20.2015 ==

- On 10.20.2015 this website went public. Maryland Governor Hogan, Maryland Senators and Congressmen, and other politically relevant people were notified shortly there after. See "MORE / STATUS" menu item for a list of updates moving forward.

== Situation Status as of 12.23.2015 ==

- On 12.21.2015 The Consumer Financial Protection Bureau (CFPB) sent me an email indicating my complaint had been forwarded to them from Congress and they would review it to determine if the matters at hand fell within their jurisdiction. On 12.22.2015 the CFPB notified me via email that my complaint had been sent to Bank of America seeking information related to steps that were taken and/or that would be taken to address my complaint. On 12.23.2015 an internal investigator from Bank of America made phone contact with me and we had 45 minute conversation. More will be posted on this matter as it progresses. See "MORE / STATUS" menu item for a list of past events leading up to this current status.

== CFPB Case Status as of 1.19.2016 ==

- 1.19.2015 Bank of America has provided an initial response to the CFPB. Purportedly, it stated nothing other than they needed more time to investigate the situation. They were granted 60 days to respond ( it is not clear if that is 60 days from 12.23.15 or from 1.5.16 or from 1.22.16). Apparently this 60 day response extension is a natural part of the process... In the meantime, the website is picking up some steam from a distribution perspective, and more relevant people are being notified and updated weekly. Relevent "docs" are still being added every few days. At this point, the additional docs are mostly providing explanations and insight into "why" the banks are doing what they are doing and/or "the effects" of this cash cull AND they are all my correspondence with all relevant parties related to this ongoing situation.

== The Bank of America Employees with personal involvement in this nefarious BofA experience ==

- David Tinkler, Assistant General Counsel, Legal Department-Bank of America

- Karen Spagna, SVP - Home Equity Underwriting and Fulfillment Executive

- Jennifer Bone, SVP - Performance Executive

- Dwight Carlisle, VP - Fulfillment Unit Leader

- Betty Watson, VP - Team Manager

- Email addresses and phone numbers for them can be found at "BofA Details/Contact Info for BofA Execs"

- Very detailed email dialogue with all of these individuals included on the BofA Details menu

- Fil Sarabia, Enterprise Customer Service (Added 1/23/2016 and full name possibly Marie Fil Sarabia)

== The BIG Picture ==

- My experience with Bank of America (and PNC Bank) is an EXAMPLE of what is transpiring in the "HELOC Crisis".

- The HELOC Crisis is a bank contrived financial crisis that started playing out in 2014 and will continue thru 2018. Do NOT underestimate the implications of my experience. Lines of Credit originated in the 2004-2008 time frame should be going thru a reset process ( a renewal process), but Banks have the general public (and maybe the government) convinced these were mortgages and not renewable revolving-credit products, and they are arbitrarily freezing the lines of credit for numerous profit-centric and credit control reasons.

- Via this contrived crisis, 3.3 million Americans will be directly affected financially. 350 million Americans will be affected indirectly as a result of a decrease in consumer spending.

- Via this contrived crisis, banks are removing the following from the pockets of middle income America:

- $16 Billion in 2015

- $32 Billion in 2016

- $48 Billion in 2017

- That is A LOT of disposable income to move from consumer pockets to bank vaults and investor pockets in a very short period of time.

- Via this contrived crisis, we can expect to see 66,000 unnecessary/unwarranted foreclosures nationwide.

- The primary reason this has gone on for 2 years so far without more attention is because in general, the cash cull is happening to each affected citizen a 200-500 dollars/month at a time. My situation was/is extreme due to the size of my line of credit, (I was told my $900/month payment would adjust to 2600/month) and I'm screaming about it because of the magnitude of the problem that creates in my life. If my credit line was a lot smaller, the nefarious behavior would affect me to a lesser degree, and I would likely never have expended the energy to speak out (even though I and others have been able to see this scam since the pieces started falling in place over 10 years ago).

== Supporting Documents ==

- As this situation has progressed, several sets of supporting documents have been prepared, with each set being specific to a target audience. The most recent document list is being prepared for the CFPB. From this point forward that list will become the master document list and it will simply be appended to with further documentation.

== HELOC ABCs ==

- The "HELOC ABCs" link on the top menu provides a very simple explanation of what HELOCs were (unconvoluted revolving lines of credit / secured credit cards) , what they are today (derivative banking products / derivative mortgage products / convoluted revolving lines of credit ), and what they should be again in the future ( unconvoluted revolving lines of credit / secured credit cards, the standard mode of home financing whose appropriate existence would abolish the racket know as our mortgage industry at this time).

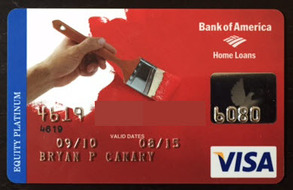

The CREDIT CARD on the right IS MY HELOC ACCOUNT!!. HELOCS ARE CREDIT CARD ACCOUNTS. HELOCs ARE NOT MORTGAGES!! HELOCs ARE NOT SUPPOSE TO LOOK OR ACT ANYTHING LIKE 10 YEAR ARMS!! Believing that a HELOC is a type of mortgage is like believing SALT is a type of PEPPER.

Unconvoluted HELOCs are the MOST powerful, consumer/citizen friendly banking product that have ever existed, and they are currently EXTINCT due to an intentional effort by for-profit bankers in the mid 2000s, and this is a situation I am seeking to reverse with this outing.

If you believe mortgages should "require" the pay down of "equity", you are actually caught in a cognitive trap of the bankers design. If you believe getting equity out of a home should involve "a cash out refinance", you are caught in a cognitive trap of the bankers design. The simplest and most beneficial form of home financing is the use of revolving lines of credit, which can be issued by states or our federal government, providing interest to our communities and our country instead of private bankers.

Having a very clear understanding of the origins of HELOCs as secured credit cards, their path to extinction, and the motives for such a trajectory, will put this entire situation in a very different light . HELOC ABCs is a must read... (shortcut: /heloc-abcs.html )

== My Experience with Bank of America (in a nutshell) ==

- An arbitrary denial for a renewal has converted a $900/month payment into a $2600/month payment. There was no Renewal Application process, no home appraisal and no Income verification done. -- It's called freezing a credit line and forcing a payoff -- BUT, Bank of America (and all the other banks doing the same thing) have everyone fooled into believing HELOCs are some type of creative mortgage instead of revolving lines of credit...

In my situation with Bank of America, my HELOC renewal was arbitrarily denied. (My secured credit card renewal was arbitrarily denied). Bank of America first claimed our Agreement had no renewal clause and then they simply stated they were not offering any type of renewal process. No renewal application process. No home appraisal. No income verification. That arbitrary change in their standard operating process deviated from that which was in place when the not was originated in 2006 and it deviated from verbal promises implied during origination. Furthermore, that arbitrary decision converted my $900/mo interest only payment into a $2600/mo payment. (a 288% monthly payment increase -- a $1700/mo payment increase).

Bankers would like you to believe this new payment is 'principal and interest' payment, but you must remember that my home equity was entrusted to BofA as 'collateral' for a revolving line of credit and there is never a time when that agreement should be able to be 'converted' to a mortgage-ish type situation on a bankers whim. A proper way to think about this is as if your credit card company arbitrarily decided not to send you a new credit card when your old card expired, and they then demanded you pay off your balance at a very aggressive rate. That is, in fact, exactly what is transpiring. See HELOC ABCs for more HELOC education.

In proper vocabulary, bankers are 'freezing' my line of credit and they are forcing me to pay down a credit balance, and the motive is GREED as well as CREDIT CONTROL. Bankers are pulling in cash to 1) increase their cash position for investment banker and stock market valuation 2) pay out cash dividends to investors and 3) to reduce the "cheap" money available to their customers and and in turn making that money available to be loaned back out at higher interest via other types of mortgages and unsecured credit cards.

When an arbitrary decision by a banker can cause a 288% payment increase, and an unconscionable amount of stress on individuals and the communities they spend money in, we all need to wake up.

The money leaving consumers pockets and going to banker vaults instead of economic spending due to this scam is as follows: $16 Billion in 2015, 32 Billion in 2016, and $48 Billion in 2017. That is a lot of disposable income to remove from the economy at this point in time...

- The FAKE Payment Reduction Application Process

After notifying me of the 1700/mo payment increase via a credit line freeze that BofA wanted me to believe was a standard part of a mortgage agreement, Bank of America "voluntarily" offered a payment reduction application process that would reduce the $2600/month payment to $1900/month. (A 288% payment increase would be reduced to a 211% increase ) .

This "voluntary" payment reduction application process was likely spurred on by government encouragement to reduce these reset payment increase situations. Seemingly, the government either does NOT understand that these HELOCs should not have been 'mortgage-ish' products to start with OR they do NOT want to expose the truth behind this cash-cull. In either event, Bank of America made a public promise to the government and consumers to work with consumers by offering a payment extension opportunity, but behind closed doors they contrived Program Guidelines and convoluted business processes that enabled them to decline all incoming payment reduction applications. The entire payment reduction application and denial process was FAKE and scripted and the employees involved were KNOWINGLY participating in the scam at a systemic level.

If you feel a FAKE underwriting process seems CRAZY, check out these links. 6 BofA whistle blowers are on record for exposing this EXACT type of behavior in 2013. http://www.propublica.org/article/bank-of-america-lied-to-homeowners-and-rewarded-foreclosures and here's another view of it.. http://www.alternet.org/corporate-accountability-and-workplace/how-does-criminal-enterprise-engaging-large-scale-fraud-and Per the article, $500 bonuses and gift cards were given for placing Accounts into foreclosure.

One would think after getting outed in Federal Court behavior might change? Where is the main stream media on this? Where is the Congressional outrage? Where is the congressional oversight? Where are the Congressional Hearings? This is Banking Division wide racketeering in plain view... This is organized crime in plain view...

- The DEVIANTS -- Bank of America Execs directly involved in my experience include David Tinkler (Asst General Counsel), Karen Spagna (Sr. Vice President), Jen Bone (Sr. Vice President), Dwight Carlisle (Team Leader), and Betty Watson (Vice President). The "C" Level Execs claiming to be most oriented outwardly to Customer Service are Brian Moynihan (CEO) and Anne Funicane (Global Chief Strategy and Marketing Officer). Moynihan and Funicane were directly notified of this situation on 9/23/2015. Suggestions for self-correction were provided. They have chosen not to acknowledge the problem nor take corrective measures. Contact info (email and telephone) for the deviants can be found here /contact-info-for-bofa-execs.html

- A GLIMPSE at the DEVIANCE performed by the DEVIANTS as it relates to the fake underwriting process in June 2015

-- Bank of America Employees refused to divulge underwriting program guidelines prior to starting underwriting process. There is NEVER a time when underwriting Program Guidelines should not be shared with a consumer. Bank of America tipped their hat to their nefarious intentions BEFORE the fake application process was every entered!

-- Bank of America Employees refused to divulge underwriting program guidelines at the time of application

-- Bank of America Employees refused to divulge underwriting program guidelines during the underwriting process

-- After a 1 month long, full underwriting process, a scripted, fake denial process was executed. A fabricated debt value was combined with a non-transparent debt-income ratio calculation to make the consumer feel they did not qualify. When appropriate questions were asked about the math related to the calculation, the Customer Service Agent claimed not to have relevant line item details for half of the debt income ratio calculation, and attention manipulation techniques were intentionally deployed to divert customer attention from the false math to the other items which were not relevant. Numerous illogical statements were made by the customer service agent to keep the true nature of the scam hidden. Anyone with just a little underwriting background would have laughed at the script.

-- Upon escalation, Betty Watson, Vice President, exposed more details regarding the mystical underwriting/program guidelines. She verbally presented them as follow: "The consumer must be below 45% for both the 15 year and 25 year ratio to qualify for the 25 year repayment term". And if you know anything about ratios and underwriting, you now can realize why they refused to divulge their program guidelines until forced to do so.

-- When pressed for details on the non-sensical program guidelines Betty LIED, claiming they were OCC guidelines. She did not know I had already gone thru two HELOC resets with PNC Bank and that I knew her claim to be false. I told her she was lying and demanded documentation supporting her claim OR the name of the Bank of America Exec responsible for choreographing the entire fake underwriting process. She recanted the following day and indicated that she and other questioned the Program Guidelines when they were presented in an employee meeting indicating all involved knew these were not legitimate program guidelines. When asked, Betty REFUSED to put the program guidelines in writing. When asked, Betty REFUSED to put the math related to my debt and income information in writing.

-- Dwight Carlisle, Vice President (Betty's Boss) was engaged via email. Dwight REFUSED to answer simple questions related to the defiance. Dwight REFUSED to acknowledge the program guidelines that were used to deny my application.

-- Jenifer Bone, Senior Vice President and Karen Spagna, Senior Vice President (Dwights Boss and her boss) were engaged via email. Both REFUSED to take any steps to get involved in the nefarious situation. At my request, my situation was forwarded to Bank of America Legal.

-- David Tinkler, Assistant General Counsel sent an initial email that was illogical and non-transparent. I replied with a long email detailing everything in writing that had transpired. He responded on a new email string with an offer for the payment reduction as long as I signed a non-disclosure agreement. During subsequent dialogue David attempted to deny he was in receipt of information related to my situation and display a consistent level of incompetence throughout the dialogue. Eventually I declined the offer, as I felt this was too large of a scam to be swept under the rug.

-- TO THIS DAY... Bank of America has refused to put in writing the Program Guidelines used to deny my application, they have refused to put in writing anything related to the ratios and calculations used to deny my application. Furthermore, a formal denial letter was sent via US Mail indicating my "current/proposed" debt was too high for qualification, and the problem with that statement is that my current debt was never evaluated, and my proposed debt was not a problem. It was a debt calculation related to a 15 year ratio, which is irrelevant, that caused the denial, and as such that letter is indicative of mail fraud (if nothing else..).

- 750,000 fellow FISH in the BARREL -- I'm only 1 of 750,000 financial responsible citizens that may be caught in this derivative HELOC Reset trap with Bank of America. I have an 837 credit score and this Line of Credit was established at 85% of my homes value when originated 10 years ago. Very conservative banking on both sides of the table 10 years ago has turned into a deal with the devil today. I have 10 accounts with Bank of America (small business and personal, check/credit card/HELOC), and I've been a faithful customer for 15 years.

== Industry Wide Collusion ==

- The collusion in the Mid 2000s' -- Bank of America isn't the only deviant organization in the industry. Legal Departments across the industry colluded in the mid 2000's by dumbing down or removing renewal clauses and by adding non-natural repayment terms to otherwise pure HELOC Agreements industry wide. Pure HELOCs Agreements were the most POWERFUL consumer banking product in the industry, and pure HELOC Agreements were modified to benefit bankers. The Agreements causing these problems are called HELOC Agreements by bankers to confuse the public. These toxic Agreements were derived from pure HELOC Agreements, but in their current form they are properly referred to as a derivative HELOC and/or a derivative mortgage product. Read first section in the Chronology for more on this industry wide shift as I saw it happen in the mid 2000s /chronology.html

- The Big Banks are all in on the game -- Bank of America, Wells Fargo, and JP Morgan/Chase originated the bulk of the derivative HELOCs from 2004-2007, so they will be the most involved in the current, deviant HELOC Resets, but ALL big banks are in on the game because as a group, they had to remove pure HELOCs from the marketplace to sell these derivative products. http://www.realtytrac.com/news/mortgage-and-finance/heloc-resets-report/

- PNC Bank was converted to the dark side in spring 2015 -- I've provided documents in this website related to two PNC HELOC Resets. In late 2014, PNC did NOT offer a renewal option on a reset even though it's clearly outlined in the agreement. Ignoring the renewal option forced a 208% payment increase, BUT they voluntarily offered a no fee modification that reduced that to a 45% payment increase. A decent solution to an otherwise crooked situation. HOWEVER, in another reset situation in Summer 2015, they have totally changed their approach. Their notification letter is no longer transparent. It indicates a $331/month payment will be adjusting to $830/month and provides no simple, actionable options for avoiding the increase. What happend to PNC between November 2014 and Summer 2015 to turn a compassionate heart callus? Oh..andwhy does their new notice look a lot like Bank of America's notices? /bank-documents-bofa-and-pnc.html

- The Bank Documents alone tell the story -- Bank Documents for both Bank of America and PNC are included in this website. The documents have been annotated, and a review of these alone is enough to realize something dramatically wrong is transpiring, even if you skip the rest of my story. There never was/is a time when 288% and 208% payment increases were "intended" consequences of opening a line of credit.

- The Big Banks are all still in collusion today, and it's sitting in plain view -- Derivative HELOC Agreements with dumbed down or missing renewal clauses and mortgage-ish repayment terms are all that you will find in our marketplace today. The absence of a pure HELOC Agreement, which is the one most beneficial to the consumer, and least beneficial to the banker, is indicative of on-going industry wide collusion today, verifiable in plain view today. Bank of America advertises a HELOC, but when you drill down the actual Agreement details and vocabulary used changes to that found in "mortgages" and there is a repayment term. /2015-bofa-heloc---a-derivative-in-plain-view.html Where are the PURE, RENEWABLE revolving lines of Credit?

== The HELOC Reset Crisis 2014-2017 ==

- The Crisis -- Collectively this bank-contrived mess above is referred to as "the HELOC Crisis" or "the HELOC Reset Crisis". This crisis started playing out in 2014 and will continue thru 2017. It will peak in 2016 and 2017. The timing of the crisis is related to the 10 year Reset Term/ Draw Term in the derivative Agreements that were originated in the real estate run up from 2004-2007.

- Industry Wide Scope -- 3.3 Million US Citizens are caught in this trap industry wide. This bank-contrived cash-cull could remove $16 Billion/$32 Billion/$48 Billion in years 2015/2016/2017 in disposable income from our economies each year for the next 2-5 years, and it could lead to as many as 66,000 unnecessary foreclosures. More on these numbers below and that these websites: http://www.realtytrac.com/news/mortgage-and-finance/heloc-resets-report

and https://www.youtube.com/watch?v=lKnVOiqw640 - The "Reset" Process Explained -- The RESET process is supposed to be a "renewal" process. It denotes a time when collateral and income are re-verified at which point the banker and the consumer would typically agree to do business for another 10 years. The reason the term "Reset" doesn't make sense in the current situation is because this artificial conversion from a line of credit to a mortgage-ish repayment term is not natural to a pure HELOC Agreement. HELOC ABCs are a MUST read to truly understand the blatant manipulation in this situation.. /heloc-abcs.html

- No Proper Mass Media Coverage -- This crisis has NOT gotten proper mass media attention from major TV networks or major reporting networks such as the Wall Street Journal, The New York Times or the Washington Post because most in our society do NOT understand what HELOCs were to start with!? Bankers also have very close ties to our mass media owners and editors, and proper media coverage would be problematic to our bankers. JP Morgan has had controlling interest of all print based news in the United States since 1915. (info on that below). Reporters at the three newspapers above were notified of this story in September 2015 and none responded to those notifications. I have provided a short list of articles that all fail to identify the true origins of this crisis. When you compare that reporting to the realities shown in my documentation, you will realize that our current reporting is the result of a lot of under-informed individuals or intentional dis-information. /data-reference-page.html

- Other Media Coverage -- An internet search for "heloc crisis" will return a few dozen articles from secondary and tertiary publishers. None have properly identified the true nature of the deviance. All are assuming HELOCs are a bad mortgage and simply assessing the situation and forecasting down the road. None are looking far enough back and connecting the bad mortgages to their purer parent, the secured credit card. All are "underestimating" the payment adjustments, and it's apparent that some of the articles have been published nefariously to minimize the crisis and/or to create confusion regarding the situation.

== Summary ==

- I'm Angry and these employees have made this a personal matter for me -- My $2600 payment, a 288% payment increase became effective September 28, 2015. and I'm angry. The employees involved in this situation have knowingly and wilfully participated in a division wide scam that is affecting my stress levels, and I'm returning the energy to them and all they have conspired with with each and every keystroke.

- Action is Appropriate -- As citizens we aggregated a portion of our energy to create a Federal Government. Our federal government created a banking system that "ideally" would be in the best interest of us, the citizens. Truthfully, the banking system was only in the best interest of the citizens at one point in our history and that was during Andrew Jackson's tenure in the 1830s. If we continue to allow banks to continue to originate the derivative HELOC products (and do ALL the other negative things they are doing to us at a Federal Level), not only will we suffer in the next 2-5 years as a society, citizens will be permanently cheated of a PURE version of a HELOC, the most powerful consumer financial product that has ever existed. For those who wish to keep the Banking Game going at a Federal Level, my request to you is simple... KEEP THE CITIZENS AND THEIR HOME FINANCING OPTIONS OUT OF THE BULLSHIT. the concept of government oversight for large banks needs to be forgotten, as it has been proven to be an impossibility. It's the deviant bankers that need to be thrown out, and that is that.

- Banking Quotes -- Most individuals erroneously believe, as I once did, that banking is a 'service for the public' when in fact, for-profit bankers are in the business of control via credit. Below are two of many quotes that I was surprised by as I started looking into my banking problems with Bank of America.

- Thomas Jefferson - “I sincerely believe that banking establishments are more dangerous than standing armies...”

- Abe Lincoln - “I have two great enemies, the Southern Army in front of me and the bankers in the rear. Of the two, the one at my rear is my greatest foe"

- For more: http://www.themoneymasters.com/the-money-masters/famous-quotations-on-banking/

- Consequences of Inaction -- This situation presents a relatively simple and verifiable problem in our for-profit banking system with wide reaching consequences. There are in fact far larger and far more damaging financial games being played, but most are out of the reach of understanding of the average citizen. Fake undewriting processes and product voids in the marketplace are NOT, however, too difficult for most to grasp. If this isn't a banking problem worth solving, we, as an organized society under a Federal Government, need to rethink why we created a Federal Government in the first place. Most who currently own homes did NOT grow up with this level of overt, capitalistic, financial manipulation of the masses (it was far more subtle back then). No child should have to grow up with this type of Fascist, Big Company-vs-Individual Citizen war fare in banking or in life. The children in our society deserve better leadership and better banking than this. Our failure is both our problem and their problem, and no one should look on our current legacy with pride.

- Actions I've take to date -- Please see the Status menu item at the top of the page for updates on actions I've taken or that have been taken by others to date. I have contacted Governor Hogan of Maryland, Senator Shelby of the US Committee on Banking, Maryland Senators and Congressmen, all 50 Governors, and all 100 US Senators. Now they need "encouragement" from the masses to take action. I've also notified Bank of America directly and about 100 banking execs of this website.

- Suggestions for Individual Action -- There are many things that individuals can do to make this a Big Deal.

- Post this URL on your social media feed

- Personally share this URL with anyone who has a HELOC

- Share this situation and this URL with your Mayor, your Governor, your Senators and your Congressmen.

- Share this situation and this URL with every real estate agent you know. Ask them to get their state Association of Realtors involved, and ask them to get the National Associations of realtors involved. Realtors are a very powerful and independent force for governmental change. They have a very strong communication network. If nothing else, realtors can share this information with all prospective home buyers, enabling home buyers to select a mortgage company that is best for them.

- Share this situation and this URL with every mortgage banker you know. If nothing else, this will provide independent mortgage originators with a very powerful educational tool for their customers.

- Suggestions for Group Action -- Do the same things as outlined in individual action, but do it in small groups.

- Small Groups could include: neighbors on a block, co-workers, church/synogogue/mosque groups, fraternities and sororities, civic organizations, labor unions, college campus clubs, etc.

- The key to CHANGE is to keep the focus on the BANKERS and the BANKING until it is fixed! -- Every problematic situation in our society, both nationally and globally, is related to banking in one form or another. Always follow the money in any situation and at the top you will find bankers, banking interests and globalists. Stay focused on BANKING for the foreseeable future and we can realize change.

If/when you get sucked into arguments related to dichotomies such as democrats vs republicans, Christians vs Muslims, blacks vs whites, pro-life vs pro-choice, socialists vs capitalists, tax cuts vs tax increases, your attention is getting scattered to topics that are, in fact, all influenced at a greater level by bankers, banking interests, and globalists.

Arguments about those topics are being induced by the banker-backed media to keep our collective attention scattered. Your ATTENTION is your ENERGY. UNITY and FOCUS are the states of being required to achieve CHANGE. Get the BANKING fixed, and THEN you can go back to your life of battling over opposing perspectives related to other issues.

Document Outline

- Town Crier Event - 21st Century Style (Governor Hogan, 50 Governors, 100 Senators, plus some...)

- The HELOC Reset Crisis (2014-2017) -- a derivative HELOC Problem...

- The HELOC Reset Crisis is NOT related to...

- Racketeering - Bank of America Style

- Industry Wide Collusion - Derivative HELOC Agreements - mid 2000s

- Industry Wide Collusion - Derivative HELOC Agreements - TODAY!!

- The Proceeds for Bankers are Losses for Citizens

- Short Term -- The HELOC Reset Crisis and cash-flow

- Bank Racketeering in our Courts - A recent trend - Customer Service Agent bonuses for forcing foreclosures..

- Our Media...

- Historical Quotes of Relevance

- Summary

1) Town Crier Event - 21st Century style

Governor Larry Hogan of Maryland was notified in writing and electronically of this website on 10/20/2015, as was Senator Shelby of the US Senate Committee for Banking.

The Governors of all 50 states were notified of this website via their contact-us pages and twitter on 10/20/2015.

Maryland Senators and Congressmen, were a select group of Congressman and others nationally and internationally. Bank of America will get their formal notices on 10/21/2015.

Please click "Letter to Gov. Hogan" on the top menu for all details related to information sent to Governor Hogan. Please click on the "Status" menu item for general info about distribution and progress. Do an internet search on #bofaracket for tracking twitter activity.

For everyone in our country who is seeking "appropriate and significant" banking reform, please educate yourself on this situation via this website, share this URL with others, and reach out to your state Governors, Senators and Congressmen and encourage them to get their arms around these deviant bankers.

The Governor's are a more appropriate contact than Senators, in my opinion, as each state could see as much as $300 million in reduced consumer spending for the next 2-5 years due to this industry-wide cash-cull, and the Governors will be most sensitive to that situation. They can communicate with their own Senators and Congressmen to achieve federal level correction as they feel appropriate.

If you, as a citizen, can't find enough justification, motivation or inspiration in this website to speak out or reach out to others that need to make a difference regarding our corrupt banking matters, please forever hold your peace.

The Governors of all 50 states were notified of this website via their contact-us pages and twitter on 10/20/2015.

Maryland Senators and Congressmen, were a select group of Congressman and others nationally and internationally. Bank of America will get their formal notices on 10/21/2015.

Please click "Letter to Gov. Hogan" on the top menu for all details related to information sent to Governor Hogan. Please click on the "Status" menu item for general info about distribution and progress. Do an internet search on #bofaracket for tracking twitter activity.

For everyone in our country who is seeking "appropriate and significant" banking reform, please educate yourself on this situation via this website, share this URL with others, and reach out to your state Governors, Senators and Congressmen and encourage them to get their arms around these deviant bankers.

The Governor's are a more appropriate contact than Senators, in my opinion, as each state could see as much as $300 million in reduced consumer spending for the next 2-5 years due to this industry-wide cash-cull, and the Governors will be most sensitive to that situation. They can communicate with their own Senators and Congressmen to achieve federal level correction as they feel appropriate.

If you, as a citizen, can't find enough justification, motivation or inspiration in this website to speak out or reach out to others that need to make a difference regarding our corrupt banking matters, please forever hold your peace.

2) The HELOC Reset Crisis (2014-2017) -- a derivative HELOC Problem...

For those unaware there is a BANK-CONTRIVED crisis playing out right now that has not received appropriate media coverage. The crisis is related to derivative HELOC Agreements that were originated from 2004 to 2007 which had clauses related to a "non-natural" Reset process that would transpire 10 years later.

When a HELOC Agreement is not convoluted for bankers gain, the Reset process is simply a renewal process where collateral and income are re-verified, and the Banker and the Consumer agree to do business for another 10 years.

In the mid 2000's bankers dumbed down and/or removed renewal clauses, and they added mortgage-ish repayment terms that are not natural to true HELOC Agreements. The toxic banking agreements bankers and customers are calling HELOC agreements today, simply are NOT pure HELOC agreements. The problem isn't with HELOCs, the problem is with deviant bankers who have made HELOCs appear to be something they are NOT. Creating such a situation had/has numerous benefits to bankers.

Bank of America, Wells Fargo, and JP Morgan/Chase were the largest originators of derivative HELOCs during the 2004-2007 time frame, as such, they will be the most involved in this deviant HELOC Reset process. BUT as you will discover in this website, PNC Bank is in on the game, as are all others. Please read "HELOC ABCs" (link on top menu) for the full picture on this.

When a HELOC Agreement is not convoluted for bankers gain, the Reset process is simply a renewal process where collateral and income are re-verified, and the Banker and the Consumer agree to do business for another 10 years.

In the mid 2000's bankers dumbed down and/or removed renewal clauses, and they added mortgage-ish repayment terms that are not natural to true HELOC Agreements. The toxic banking agreements bankers and customers are calling HELOC agreements today, simply are NOT pure HELOC agreements. The problem isn't with HELOCs, the problem is with deviant bankers who have made HELOCs appear to be something they are NOT. Creating such a situation had/has numerous benefits to bankers.

- I'm just 1 of 750,000 Bank of America customers caught in this trap

- I'm just 1 of 3.3 Million citizens who will be facing nefarious HELOC Resets industry wide

- This will decrease consumer cash in circulation by as much as $15 Billion/year for the next few years*

- This will cause 66,000 inappropriate foreclosures*

- * - please see "More > Data Reference Page" for statistical support/explanation of all data quoted in this website

Bank of America, Wells Fargo, and JP Morgan/Chase were the largest originators of derivative HELOCs during the 2004-2007 time frame, as such, they will be the most involved in this deviant HELOC Reset process. BUT as you will discover in this website, PNC Bank is in on the game, as are all others. Please read "HELOC ABCs" (link on top menu) for the full picture on this.

Although I'm only 1 of 3.3 Million, I happen to have personal experience with HELOC Resets with both Bank of America and PNC Bank which makes me a little unusual, and I've provided a document related to another Reset situation with PNC which differs dramatically from my own. And as you will come to realize, the ability to compare three different Reset scenarios with these two banks is, in fact, what gives this outing great depth.

The overt racketeering by Bank of America employees related to the FAKE payment reduction process is attention worthy on it's own, but the bigger picture related to 1) the industry wide shift to derivative agreements in the mid 2000's 2) the arbitrary denial that got me into that fake process 3) the comparison of 3 different approaches to Resets from two banks and 4) a glaring product void in the banking marketplace will make it VERY difficult for Bank of America, PNC, Wells Fargo, JP Morgan/Chase and all other banks to explain their way out of this situation.

The overt racketeering by Bank of America employees related to the FAKE payment reduction process is attention worthy on it's own, but the bigger picture related to 1) the industry wide shift to derivative agreements in the mid 2000's 2) the arbitrary denial that got me into that fake process 3) the comparison of 3 different approaches to Resets from two banks and 4) a glaring product void in the banking marketplace will make it VERY difficult for Bank of America, PNC, Wells Fargo, JP Morgan/Chase and all other banks to explain their way out of this situation.

3) The HELOC Reset Crisis is NOT related to...

To be very clear, the problems those of us caught in this trap are experiencing are NOT related to being negligent consumers nor making bad consumer choices. Most originating these products were required to have a 725 credit score and many of these Lines of Credit were capped at 85% of a home's value. I currently have an 820+ credit score, and my credit line with Bank of America was capped at 85% of my homes value. That is all VERY conservative banking by both them and me.

I wouldn't be trapped in this situation if even a modicum of financial logic had been applied to my Reset via an appropriate renewal process. My Reset process with Bank of America played out as if I was dealing with a clan of nefarious gypsies in a back-alley deal gone bad.

The problems those of us caught in this trap are experiencing are also NOT related to HELOC products in their natural form, as previously mentioned. By convoluting HELOC Agreements with "non-natural" clauses but continuing to call them "HELOCs", the bankers have introduced significant confusion into our societal psyche. Bankers, collectively, have intentionally ruined the term HELOC. There is no better way to make the most consumer friendly credit product on the planet disappear than by having the consumers who would benefit from it most push for its obsolescence.

I wouldn't be trapped in this situation if even a modicum of financial logic had been applied to my Reset via an appropriate renewal process. My Reset process with Bank of America played out as if I was dealing with a clan of nefarious gypsies in a back-alley deal gone bad.

The problems those of us caught in this trap are experiencing are also NOT related to HELOC products in their natural form, as previously mentioned. By convoluting HELOC Agreements with "non-natural" clauses but continuing to call them "HELOCs", the bankers have introduced significant confusion into our societal psyche. Bankers, collectively, have intentionally ruined the term HELOC. There is no better way to make the most consumer friendly credit product on the planet disappear than by having the consumers who would benefit from it most push for its obsolescence.

4) Racketeering - Bank of America Style

In 2005, I entered into a HELOC Agreement with Bank of America. At time of origination the lack of a detailed renewal clause was obvious as was the non-natural, mortgage-ish repayment term, which would only be relevant if a renewal was not granted. Bank of America Attorneys had intentionally created a derivative HELOC Agreement that would behave like a Line of Credit if they wanted to renew, but they could retroactively try to claim it was similar to a 10 year ARM with an introductory Line of Credit term if they chose not to follow proper renewal processes at time of Reset in 2015. At time of origination, Bank of America customers who asked about the mortgage-ish repayment term were told to ignore it as extraneous, since the Standard Operating Procedures for time immemorial were to renew HELOC Agreements with a simple and appropriate renewal process.

In 2015, Bank of America arbitrarily denied the renewal of my HELOC Agreement. No renewal application process. No home appraisal. Bank of America Legal later attributed the arbitrary slight to a mere "matter of policy". This passive act forced me into that non-natural, mortgage-ish repayment period causing a 288% payment increase ($900/month payment increased to $2600/month effective September 28, 2015. That represents a $1700/month increase). In true "Line of Credit" vocabulary, BofA has arbitrarily "frozen" my line of credit and they are arbitrarily forcing the pay-down of my account balance. When an arbitrary decision by a banker can create a 288% payment increase, we all need to wake up.

Then to add insult to injury, Bank of America offered a "repayment term extension application process" that would reduce the 288% payment increase to 211%. Unfortunately, it was a FAKE payment reduction application process offered and executed for outward appearances only. My first $2600/month payment is due November 1, 2015, and I'm more than a little pissed off...

In my case, an arbitrary denial was required to start this trip into bankers hell. For others who did not have a renewal clause, or who did not know to ask for a renewal, their trip into bankers hell with sky-high payment increases is resulting from a derivative banking product that just so happens to turn into a bankers trap in a depressed housing market and/or due to tightened lending requirements, both of which were likely foreseeable to cowboy bankers 10 years ago.

Then to add insult to injury, Bank of America offered a "repayment term extension application process" that would reduce the 288% payment increase to 211%. Unfortunately, it was a FAKE payment reduction application process offered and executed for outward appearances only. My first $2600/month payment is due November 1, 2015, and I'm more than a little pissed off...

In my case, an arbitrary denial was required to start this trip into bankers hell. For others who did not have a renewal clause, or who did not know to ask for a renewal, their trip into bankers hell with sky-high payment increases is resulting from a derivative banking product that just so happens to turn into a bankers trap in a depressed housing market and/or due to tightened lending requirements, both of which were likely foreseeable to cowboy bankers 10 years ago.

5) Industry Wide Collusion - Derivative HELOC Agreements - mid 2000s

In the mid 2000's all big banks mysteriously started changing the clauses in their HELOC Agreements by dumbing down or totally removing renewal clauses and by adding mortgage-ish repayment terms, just like the situation I described above with Bank of America. Given all Agreements in the industry shifted in a derivative way around the same time, the collusion in the Legal Departments which were writing the Agreements is obvious.

In 2005, it was very easy for me and anyone else with a sound finance background to realize the shifting Agreements were deviant derivatives because the vocabulary related to a Line of Credit (Reset, Renewal, Account Holder, Account) had been mis-mashed with vocabulary related to a mortgage (loan, borrower, principal, repayment period), not to mention the fact a repayment period had zero business being in a HELOC Agreement to start with.

Furthermore, I and anyone with financial foresight recognized that at time of Reset, 10 years away, a depressed property value, a change in lending rules, and/or an arbitrary denial of a renewal (if the agreement had a renewal clause) could turn all of these derivative Agreements toxic by trapping consumers in situations where there was no escape from HUGE payment increases, just as we are seeing today.

Changing the agreements has obvious GREED and PROFIT motive, but few recognize that the true reason for the shift 10 years ago was for CREDIT CONTROL over financially responsible citizens and small businessmen by making pure HELOCs disappear from the marketplace. A little more on the Pros and Cons of Pure HELOCs will provide tremendous insight into motivation for making pure HELOCs disappear.

In 2005, it was very easy for me and anyone else with a sound finance background to realize the shifting Agreements were deviant derivatives because the vocabulary related to a Line of Credit (Reset, Renewal, Account Holder, Account) had been mis-mashed with vocabulary related to a mortgage (loan, borrower, principal, repayment period), not to mention the fact a repayment period had zero business being in a HELOC Agreement to start with.

Furthermore, I and anyone with financial foresight recognized that at time of Reset, 10 years away, a depressed property value, a change in lending rules, and/or an arbitrary denial of a renewal (if the agreement had a renewal clause) could turn all of these derivative Agreements toxic by trapping consumers in situations where there was no escape from HUGE payment increases, just as we are seeing today.

Changing the agreements has obvious GREED and PROFIT motive, but few recognize that the true reason for the shift 10 years ago was for CREDIT CONTROL over financially responsible citizens and small businessmen by making pure HELOCs disappear from the marketplace. A little more on the Pros and Cons of Pure HELOCs will provide tremendous insight into motivation for making pure HELOCs disappear.

A pure HELOC is the most desirable form of credit on the planet for a worthy consumer, and that is to the detriment of the banker...

- A pure HELOC, as a credit product, is the least profitable of all credit products

- A pure HELOC cuts into potential credit card profits

- A pure HELOC cuts into mortgage profits

- A pure HELOC provides a homeowner a level of credit freedom that could make ALL traditional mortgages obsolete if interest rate fluctuations were limited and/or capped (a HUGE threat to the entire mortgage industry, wihch revolves around credit control and liquidity control)

- A pure HELOC represents a fabulous working capital account for a sole-proprietor or small business person involved in real estate or other businesses where there are large cash-flow swings. That credit freedom does not make bankers happy.

An additional psychological benefit to the consumer is dramatic, to the detriment of our investment markets...

The customer benefits from pure HELOCs are never-ending, while the bankers make peanuts without any credit control over the consumer. With that understanding, it's simple to realize why for-profit bankers wanted the pure HELOC to disappear. And in fact, today, it is absent from the banking marketplace, indicative of continued industry wide collusion among Legal Departments in every big bank in the country.

- A pure HELOC acts just like an interest bearing savings account . Every penny a consumers puts towards their Account Balance, which is paying down debt on their home, creates a decreased interest payment on the following months statement. A penny saved is a penny earned, and it's easy to watch the savings add up when you can see them in the form of decreased interest payments on your monthly statement. With a HELOC there is far greater psychological incentive for conservative people to pay off a home than to invest in the stock market or the real estate market.

The customer benefits from pure HELOCs are never-ending, while the bankers make peanuts without any credit control over the consumer. With that understanding, it's simple to realize why for-profit bankers wanted the pure HELOC to disappear. And in fact, today, it is absent from the banking marketplace, indicative of continued industry wide collusion among Legal Departments in every big bank in the country.

6) Industry Wide Collusion - Derivative HELOC Agreements - TODAY!!

Currently there is no HELOC Agreement in the banking marketplace with an earnable renewal clause and without a mortgage-ish repayment term. The lack of a pure HELOC agreement in the marketplace is in fact indicative of continued industry wide collusion among the Legal Departments of all big banks, to this day, and it's sitting in plain view.

Basically, bankers are selling crack and calling it cocaine and they have assumed that most are none the wiser.

To anyone in finance, real estate, or mortgage origination this situation is so obvious it's laughable. Unfortunately, the Banking Attorneys who have created it and who are currently controlling all of our banking are too ego-centric to realize just how NAKED they all are, just like the King and his new clothes.

Basically, bankers are selling crack and calling it cocaine and they have assumed that most are none the wiser.

To anyone in finance, real estate, or mortgage origination this situation is so obvious it's laughable. Unfortunately, the Banking Attorneys who have created it and who are currently controlling all of our banking are too ego-centric to realize just how NAKED they all are, just like the King and his new clothes.

7) The Proceeds for Bankers are Losses for Citizens

Short Term -- Bankers could gorge on as much as $15 Billion/year for the next several years in unwarranted cash inflows. Bankers would like to call these inflows "principal payments", but they are in fact the forced pay-down of Line-of-Credit Account Balances (a BIG difference). Every penny the bankers bring in is a penny less that gets spent in local economies. Every penny that bankers bring in puts homeowners one step closer to financial insolvency, foreclosure and bankruptcy.

Short Term -- Bankers could cause 66,000 unnecessary foreclosures in the next 3 years. Per Bank of America's own reporting, defaults on HELOC Accounts after Reset are over 3% vs below 1% historically (and I sincerely doubt they are sharing honest reporting). Assuming a 2% increase in foreclosures is representative across the industry, 2% of 3.3 Million consumers indicates Banking Attorneys, via the creation of derivative Agreements, will be causing 66,000 unnecessary foreclosures due to this derivative HELOC scam.

And if you don't believe Banking Attorneys make money on foreclosures, you are caught in a cognitive trap. Forcing foreclosures is in fact part of the goal for Banking Attorneys as that creates work for the Legal Department. When you become familiar with the details of my experience with Bank of America, you will see that "risk aversion" was NOT a priority, and in fact, increasing risk to unheard of levels was the goal and where I was allowed to remain as long as I was willing to stomach the risk.

Short Term -- Bankers and Banking Attorneys are creating an immeasurable amount of STRESS on our society. That STRESS is going to affect a LOT of financially responsible citizens and a lot of local economies.

Long Term -- If Bankers are allowed to continue to originate derivative HELOCs while totally excluding pure HELOCs from the market, the long term effects of excess interest, financial stress, and depression of grass roots small business competition are incalculable.

And if you don't believe Banking Attorneys make money on foreclosures, you are caught in a cognitive trap. Forcing foreclosures is in fact part of the goal for Banking Attorneys as that creates work for the Legal Department. When you become familiar with the details of my experience with Bank of America, you will see that "risk aversion" was NOT a priority, and in fact, increasing risk to unheard of levels was the goal and where I was allowed to remain as long as I was willing to stomach the risk.

Short Term -- Bankers and Banking Attorneys are creating an immeasurable amount of STRESS on our society. That STRESS is going to affect a LOT of financially responsible citizens and a lot of local economies.

Long Term -- If Bankers are allowed to continue to originate derivative HELOCs while totally excluding pure HELOCs from the market, the long term effects of excess interest, financial stress, and depression of grass roots small business competition are incalculable.

8) Short Term -- The HELOC Reset Crisis and cash-flow

This very timely quote from Bloomberg may explain why Bank of America took the risk to create a "fake" payment reduction process and it may also explain why PNC Bank "voluntarily" reduced a 208% payment increase to 47% in January 2015, but has since changed course and is attempting to enforce a 255% payment increase on a close colleague of mine.

The borrowing has gotten so aggressive that for the first time in about five years, equity fund managers who said they’d prefer companies use cash flow to improve their balance sheets outnumbered those who said they’d rather have it returned to shareholders, according to a survey by Bank of America Merrill Lynch.

http://www.bloomberg.com/news/articles/2015-10-15/corporate-america-s-epic-debt-binge-leaves-119-billion-hangover?cmpid=yhoo.headline

For those not in business, there are two quotes you need to embed in your head. "Cash is King" and "cash-flow is the life-blood of a business". And when equity fund managers tell the world they want to see cash-flow boost balance sheets, CEOs and corporate execs listen.

Unfortunately for the bankers:

Unfortunately for the bankers:

- few are left in the business who have the financial background to remember the true origins of a HELOC Agreement

- few are left in the business who realize the level to which the current agreements have been convoluted to create this wonky HELOC reset situation

- few are left in the business who realize just how glaringly obvious the lack of a pure HELOC agreement in the marketplace is, and what that implies. If a market was truly competitive and customer driven, there would never be a time when the most desirable product for a consumer is totally absent from the marketplace.

9) Bank Racketeering in our Courts - A recent trend...

An internet search on "XXXXX Racketeering", where XXX is your favorite deviant Bank may surprise you...

Internet Search: "Bank of America Racketeering" -- 20+ results with publishing dates since 2010

Internet Search: "Wells Fargo Racketeering" -- 20+ results returned...

The Banks are making money hand over fist. Bank Attorneys are creating job security for themselves. Millions of consumers are getting their clocks cleaned one at a time, and while I appreciate the attorneys who are suing the banks seeking balance, lets face it, the rackets are keeping them busy and in the money too. Individuals across the LEGAL INDUSTRY are winning at everyone's expense.

** -- Gift cards for foreclosures. That is one possible explanation for my experience with the very deviant low-level Customer Service Agent at Bank of America. Lives are being wrecked by Customer Service Agents for gift cards. REALLY?!? If you think street thugs are bad, you are caught in a cognitive trap. Street thugs and gang members have NOTHING on these white collar criminals. Maybe we should start educating them on banking and pointing them at the bankers? Capital punishment for civil offenses is the way forward. End of discussion.

Internet Search: "Bank of America Racketeering" -- 20+ results with publishing dates since 2010

- http://www.alternet.org/corporate-accountability-and-workplace/how-does-criminal-enterprise-engaging-large-scale-fraud-and (all banks)

- One of the whistleblowers commented, “we were told to lie to customers.” Employees that pushed ten or more homeowners per month into foreclosure would receive a $500 bonus, and the Bank also “gave employees gift cards** to retail stores like Target or Bed Bath and Beyond as rewards for placing accounts into foreclosure.”

- http://www.usresidential.com/Headlines/foreclosure-news-bank-of-america-accused-of-racketeering-in-lawsuit-charlotteobservercom.html

Internet Search: "Wells Fargo Racketeering" -- 20+ results returned...

The Banks are making money hand over fist. Bank Attorneys are creating job security for themselves. Millions of consumers are getting their clocks cleaned one at a time, and while I appreciate the attorneys who are suing the banks seeking balance, lets face it, the rackets are keeping them busy and in the money too. Individuals across the LEGAL INDUSTRY are winning at everyone's expense.

** -- Gift cards for foreclosures. That is one possible explanation for my experience with the very deviant low-level Customer Service Agent at Bank of America. Lives are being wrecked by Customer Service Agents for gift cards. REALLY?!? If you think street thugs are bad, you are caught in a cognitive trap. Street thugs and gang members have NOTHING on these white collar criminals. Maybe we should start educating them on banking and pointing them at the bankers? Capital punishment for civil offenses is the way forward. End of discussion.

10) Our Media...

Our media has been heavily controlled by JP Morgan interests since 1915. For all intents and purposes, we've been in a 100 year mass-media controlled black out as it relates to nefarious banking. The article below quotes the US Congressional record from February 9, 1917 related to JP Morgan control

“In March, 1915, the J.P. Morgan interests, the steel, ship building and powder interests and their subsidiary organizations, got together 12 men high up in the newspaper world and employed them to select the most influential newspapers in the United States and sufficient number of them to control generally the policy of the daily press in the United States.

“These 12 men worked the problems out by selecting 179 newspapers, and then began, by an elimination process, to retain only those necessary for the purpose of controlling the general policy of the daily press throughout the country.

Furthermore, Reuters is owned by a very well-known international banking family and Reuters owns the AP, and this has existed for over 100 years as well. As such, we really should not expect media support for nefarious banking matters, and if in fact you do see a major media outlet pickup on a major banking matter, be wary, as it will likely be intended to confuse a situation. Furthermore, remember that false reporting under the guise of a smaller publisher is a tactic employed now by the media giants for creating confusion and contrast to drown out those whose reporting is truthful in nature.

Youtube.com is your friend. You would be SHOCKED at the amount of information that can be gleened from Youtube these days regarding nefarious individuals, families, corporations and government situations. Simply SHOCKED.

11) Historical Quotes of Relevance

The financial stress these banks are creating is enormous. Most individuals erroneously believe, as I did, that banking is a 'service for the public' when in fact, for-profit bankers are in the business of control via credit. Below are two of many quotes that I was surprised by as I started looking into my banking problems with Bank of America.

- Thomas Jefferson - “I sincerely believe that banking establishments are more dangerous than standing armies...”

- Thomas Jefferson - “If the American people ever allow private banks to control the issue of their currency, first by inflation then by deflation, the banks and the corporations will grow up around them, will deprive the people of all property until their children wake up homeless on the continent their fathers conquered"

- Abe Lincoln - “I have two great enemies, the Southern Army in front of me and the bankers in the rear. Of the two, the one at my rear is my greatest foe”

- Andrew Jackson - “If the people understood the rank injustices of our money and banking system there would be a revolution before morning.” And this statement is true today more than ever before in our history...

12) Summary

France - 1939. Last public execution by guillotine

France - 1939. Last public execution by guillotine

By nature Business Attorneys were meant to provide counsel to businessmen. Unfortunately, Business Attorneys have usurped the thrones of Big Business, but they don't realize just how deficient they are with regards to understanding the energetic component that accompanies every business transaction. They are also woefully oblivious to the true power of the internet.

Our Banking Attorneys are working together in collusion to create chaos for millions, and in this case they are attempting to bury the most valuable consumer credit product that has ever existed while raping and pillaging at the same time.

From my perspective, the time for Big Corporation vs Individual Consumer warfare is over. It is very last century, and the internet is the balancing tool that will help bring that battle to an end (or at very least provide balance). Demanding personal responsibility for Corporate Executives and metering individual justice for perpetrators of social crimes is the next step towards "balance".

David Tinkler, Assistant General Counsel of Bank of America, didn't seem to be a bit concerned about his role in trapping me in this game nor culpability for his part. In fact, David felt so comfortable with me after our email dialogue (which is worth reading), he sent me a friend request on Facebook...

David and all Banking Attorneys are aware that I, and all others like me, have no economically viable avenues via our civil court system to seek correction, and they are all playing that for all it's worth.

Well David, this is my way of calling bullshit on your game and that of all the Bank of America Execs and employees who participated in the scam. Below is a list of the Bank of America Execs directly involved in my Reset. Contact info for them can be found on the Bank of America Contact Us page.

To each of you, best of luck in your future endeavors.

To all "C" level execs at Wells Fargo, JP Morgan/Chase, Citi Bank, PNC and all others, welcome to the rodeo. You can thank the execs and Customer Service Agents at Bank of America for the spotlight.

Our Banking Attorneys are working together in collusion to create chaos for millions, and in this case they are attempting to bury the most valuable consumer credit product that has ever existed while raping and pillaging at the same time.

From my perspective, the time for Big Corporation vs Individual Consumer warfare is over. It is very last century, and the internet is the balancing tool that will help bring that battle to an end (or at very least provide balance). Demanding personal responsibility for Corporate Executives and metering individual justice for perpetrators of social crimes is the next step towards "balance".

David Tinkler, Assistant General Counsel of Bank of America, didn't seem to be a bit concerned about his role in trapping me in this game nor culpability for his part. In fact, David felt so comfortable with me after our email dialogue (which is worth reading), he sent me a friend request on Facebook...

David and all Banking Attorneys are aware that I, and all others like me, have no economically viable avenues via our civil court system to seek correction, and they are all playing that for all it's worth.

Well David, this is my way of calling bullshit on your game and that of all the Bank of America Execs and employees who participated in the scam. Below is a list of the Bank of America Execs directly involved in my Reset. Contact info for them can be found on the Bank of America Contact Us page.

To each of you, best of luck in your future endeavors.

- David Tinkler, Assistant General Counsel, Legal Department-Bank of America

- Karen Spagna, SVP - Home Equity Underwriting and Fulfillment Executive

- Jennifer Bone, SVP - Performance Executive

- Dwight Carlisle, SVP - Fulfillment Unit Leader

- Betty Watson, VP - Team Manager

- Brian Moynihan, CEO Bank of America

- Anne Funicane, Global Chief Strategy and Marketing Officer

To all "C" level execs at Wells Fargo, JP Morgan/Chase, Citi Bank, PNC and all others, welcome to the rodeo. You can thank the execs and Customer Service Agents at Bank of America for the spotlight.